Composites by comparison

Can composites replace steel as the back-bone of the oil and gas industry? Thibault Villette, material modelling team leader at Saudi Aramco, offers his thoughts.

The oil & gas industry has historically relied heavily on steel. Carbon and stainless steels are almost exclusively used in every part of the hydrocarbon value chain, from upstream to downstream operations, such as wells, rig systems, onshore pipelines, storage tanks, refineries, and offshore platforms. With its impressive mechanical performance to cost ratio, and resistance to hydrocarbon fires, steel continues to be consumed by the sector at a rate of around 60 million metric tons every year.

Composite possibilities

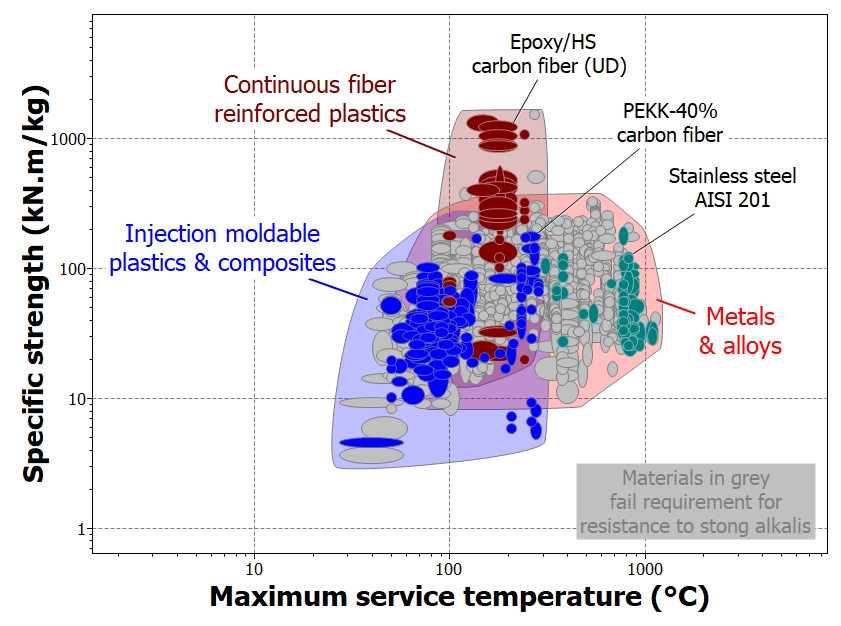

With oil and gas companies facing ageing assets, and corrosion costs estimated to exceed $2 trillion globally, new solutions are being sought for the rehabilitation of existing fields, and the construction of new ones. In this search, composites are gaining recognition. Polymer matrix composites, for example, offer excellent corrosion resistance, lower weight, and can rival steels in applications where maximum service temperatures are low to moderate. That temperature limitation is because the resistance of polymers to creep quickly decreases as a function of temperature. Another limitation is permeability. This is particularly relevant where the application requires barrier properties – the transportation of high hazard chemicals like hydrogen sulphide, for example.

Overall, it’s accurate to say that the penetration of composites within the sector has been relatively feeble. Moreover, potential growth is being hindered by several factors. First, is the maturity of composite solutions versus steel solutions. Oil and gas operators’ primary objectives are human safety, and production stability. Backed up by extensive research dating back centuries, steel engenders a great deal of confidence. Likewise, the technologies use to inspect steel asset integrity are more mature than those used in the inspection of composite structure integrity, which is a relatively new, albeit active, research area.

Then there are the initial investment costs (CAPEX). The relatively cheap cost of steel (around $3 per kg) can make buyers reluctant to adopt composite solutions, which can be up to 100 times more expensive. But that higher CAPEX is counterbalanced by lower operation expenses (OPEX). Before reaching that point, however, composites must go through a particularly long qualification period. To meet the colossal investments required for new oil and gas projects, assets are designed to last 20, 30, or 40 years. The qualification tests imposed by international standards must cover a significant portion of that lifecycle to be considered representative. This results in a testing process that is far longer than in most other industries. For instance, the minimum required testing time for the qualification of a new composite pipeline product typically exceeds a year and a half.

Internationally acknowledged ASTM, API, or ISO standards are used to qualify composite products, though they were primarily developed with steel as the targeted material. The progressive development of qualification standards specific to composite products (e.g., standards developed by company DNV) will help release some unnecessary constraints on composites, and ultimately decrease the cost of investment. Shorter development and qualification time, and realistic safety coefficients will help lower this further. So how does a company that has built up knowledge, experience, and confidence in steel begin to explore the pros and cons of composite solutions?

Making an informed choice

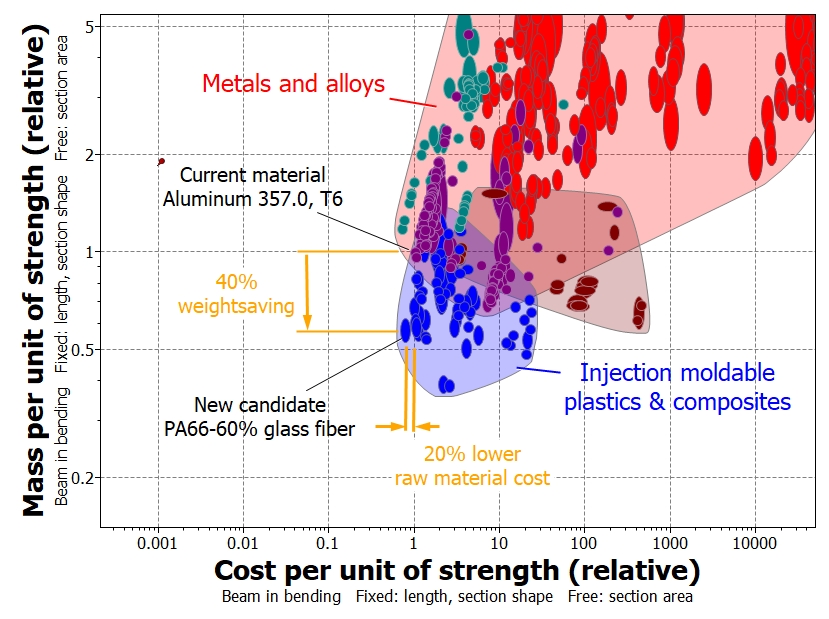

One key element is having the right information about materials, and the tools to exploit that information. If you can identify the likeliest candidates for your applications from among the ‘universe’ of material possibilities and compare them easily with current materials, then you can focus material studies and qualification and save valuable time. Saudi Aramco uses the leading software tool for materials selection and graphical analysis of materials properties, for this purpose. The tool provides an extensive database of materials and their properties, and offers instant charting and filtering. For example, the software allows the user to easily compare plastics to metals, or choose materials that meet safety criteria.

Saudi Aramco has been deploying non-metallic solutions since 1998, and first began using material selection software to review candidate materials for future reinforced thermoplastic pipelines (RTP) projects. Using the software, material selection was performed according to diverse criteria, such as heat deflection, chemical resistance, processability, and cost. Through the tool, candidate materials for one project were reduced from 7,000 possibilities to 10 likely options, making further investigation much more viable.

In broader terms, the tool brought a new and complementary view to the project that was immediately beneficial. The technical dialogues that take place between Saudi Aramco and its external co-developer are critical. The software acts as a neutral ‘expert’ for all stakeholders to use to review and compare material options, opening new channels of discussion within the project team.

Next steps for the future

As previously mentioned, the composites market in the oil and gas industry is in its infancy, though increasingly stringent global regulations on carbon emissions are playing more in favour of composites than steel. And the sustainability potential of composites is increasingly being recognised. One example is the use of composite pipelines for the elimination of flaring, through the transportation of gases from the well to the gas-processing station.

Research within the industry, such as conducted at the Nonmetallic Innovation Centre (NIC) founded by Saudi Aramco and TWI in Cambridge, has identified further opportunities to expand the demand for polymer composites. By bridging the gap between oil & gas companies (end-users) academic institutions and composite manufacturers, the NIC aims at developing the next generation of ‘affordable’ composite pipes and liners, and increasing their adoption by developing/improving international qualification and fitness for service standards, as well as inspection and monitoring technologies.

While the foothold that composites have in the oil & gas sector may currently be small, the potential for growth is there. But to fully explore all material options (with their benefits and drawbacks), avoid dead-ends, and realise that potential — materials selection and analysis tools should be considered a strategic asset. An asset that is fully integrated into corporate strategy.