Opening the door of opportunity

Magna Exteriors’ president, Grahame Burrow talks about the growing market for thermoplastic liftgates as automakers seek every opportunity to lightweight in the face of increasing emissions and fuel economy regulations. Mike Richardson reports.

The continuing popularity of sport utility and crossover vehicles, combined with changing global emissions standards has seen many automotive OEMs adopting lightweight, thermoplastic liftgate modules.

Magna says it can offer automotive OEMs expertise in delivering these recyclable modules, which provide up to 25% weight savings compared to steel versions and allow for broader design flexibility.

The company’s thermoplastic liftgate modules are said to answer the growing demand for products that help automakers cut vehicle weight, improve fuel efficiency, reduce CO2 emissions, extend electric vehicle battery range and improve aerodynamics. They also enable greater design freedom, which means customers are better able to shape their brand image and perform more frequent and cost-effective mid-cycle refreshes.

Magna began producing thermoplastic liftgates in 1999 for a premium European carmaker, followed by several more European launches. The first North American thermoplastic liftgate was on the 2014 Nissan Rogue, and two more followed in 2018 with the launch of the 2019 Jeep Cherokee and 2019 Acura RDX. This year, Magna added two thermoplastic liftgates in China and has several more coming in the next few years. In total, more than three million thermoplastic liftgate modules have rolled off Magna production lines around the world so far.

Going for growth

IHS Markit estimates the global sport utility vehicles (SUV) market will grow from 34 million units of 2018 to almost 43 million units by 2025. Magna sees a considerable growth opportunity to provide thermoplastic liftgates for this growing segment.

“Magna is a $40 billion mobility technology company with a footprint in 28 countries, employing more than 168,000 people,” says Magna Exteriors’ president, Grahame Burrow. “Our exteriors group focuses on specific parts of the car that are predominantly compression and injection moulded parts with generally some kind of paint or chrome coating on them and converted into assembled modules.

“We produce thermoplastic composite liftgates for the European, China and North American markets at about one million units each year across several different customers. Only 5% of the current liftgate market is composite, and we see that number doubling within just 10 years. Most of our investment in terms of new facilities and large equipment is generally around future liftgate business.”

Driving that thrill

Clearly, thermoplastic liftgates can help improve perceived quality for OEMs and end customers. The Jeep Cherokee and Acura RDX liftgates look impressive – not just from the exterior, but the side view and the interior too.

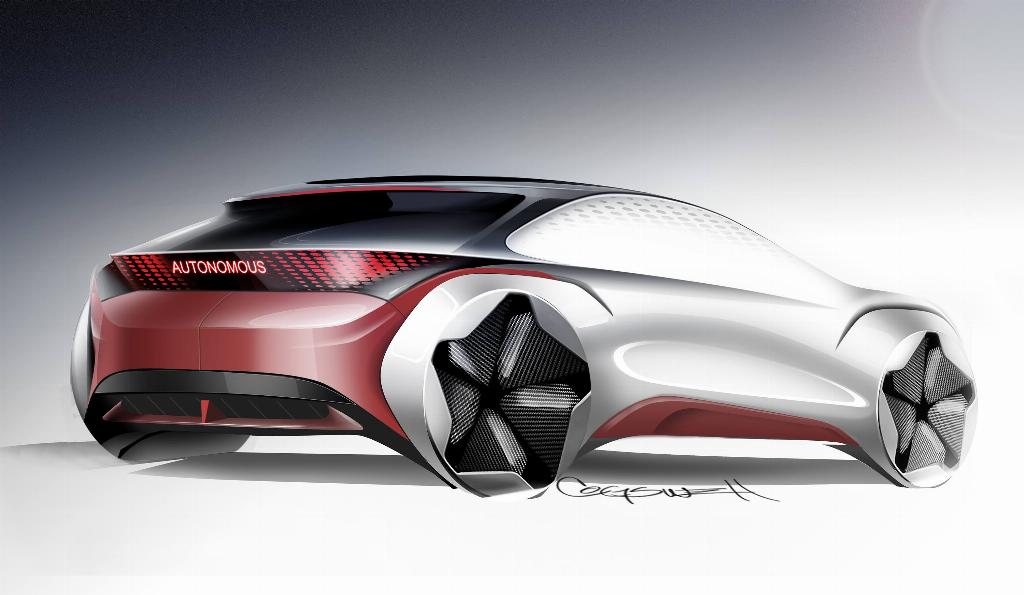

Burrow says the company’s mission is to create excitement around the outside of the car: “Our mantra is that it doesn’t matter if there is a driver in the car or not; it still has an exterior and it is our job to create products that are aesthetically pleasing and functional for users. We help our customers achieve this through innovative manufacturing processes. Injection moulded exterior panels can have greater drama, with deeper draws and tighter radii. We can also integrate features, such as electronics, glass and trim within the production process so we can deliver complete, dimensionally stable modules in colour sequence.”

Magna liftgates are produced within standard cycle times, allowing the company to run very high-volume programmes. Unique materials such as glass-reinforced inner panels and modified Thermoplastic Olefin (TPO) outer panels ensure better structural and thermal expansion properties.

“Our joining system generally uses adhesives for bonding the inner and outer panels together. In some cases, temperature controls are applied to achieve faster cures. We often assemble glass panels with adhesives too. Three primary large components – and in some cases four, if you include the top spoiler piece – are bonded together. Once complete, assembly of hardware such as closure devices, lighting, electronics and mechatronics can begin.”

In addition to mass savings, design freedom and component integration, key benefits of Magna’s full-system assembly and delivery approach include lower tooling investment and increased throughput at customers’ assembly plants.

“We can drive more efficiencies within our customers’ manufacturing processes – whether it is in the paint line or the assembly process - by reducing overall resource requirements and floorspace and helping them reallocate those resources toward adding content that differentiates their vehicles even further. The customer needs only one production entry point to take the liftgate assembly and put it onto the car as opposed to having it built up through the course of their own assembly line - which is typical for steel liftgates. This leads to improved ergonomics, lower capital investment and lower tooling investment when you look at the entire value stream.”

The look and feel

Burrow concludes by pointing to the global demand for liftgates, which show up on SUVs, hatchbacks and vans. About 60% of the world’s vehicles have a back door with approximately 95% of those being made from steel and 5% from a combination of plastic/composite materials.

“This trend is rising sharply,” he ends. “Our OEM customers are aware of these advantages and I cannot think of an OEM that isn’t currently purchasing thermoplastic liftgates or considering entering the market. It’s truly a growth segment for us.”